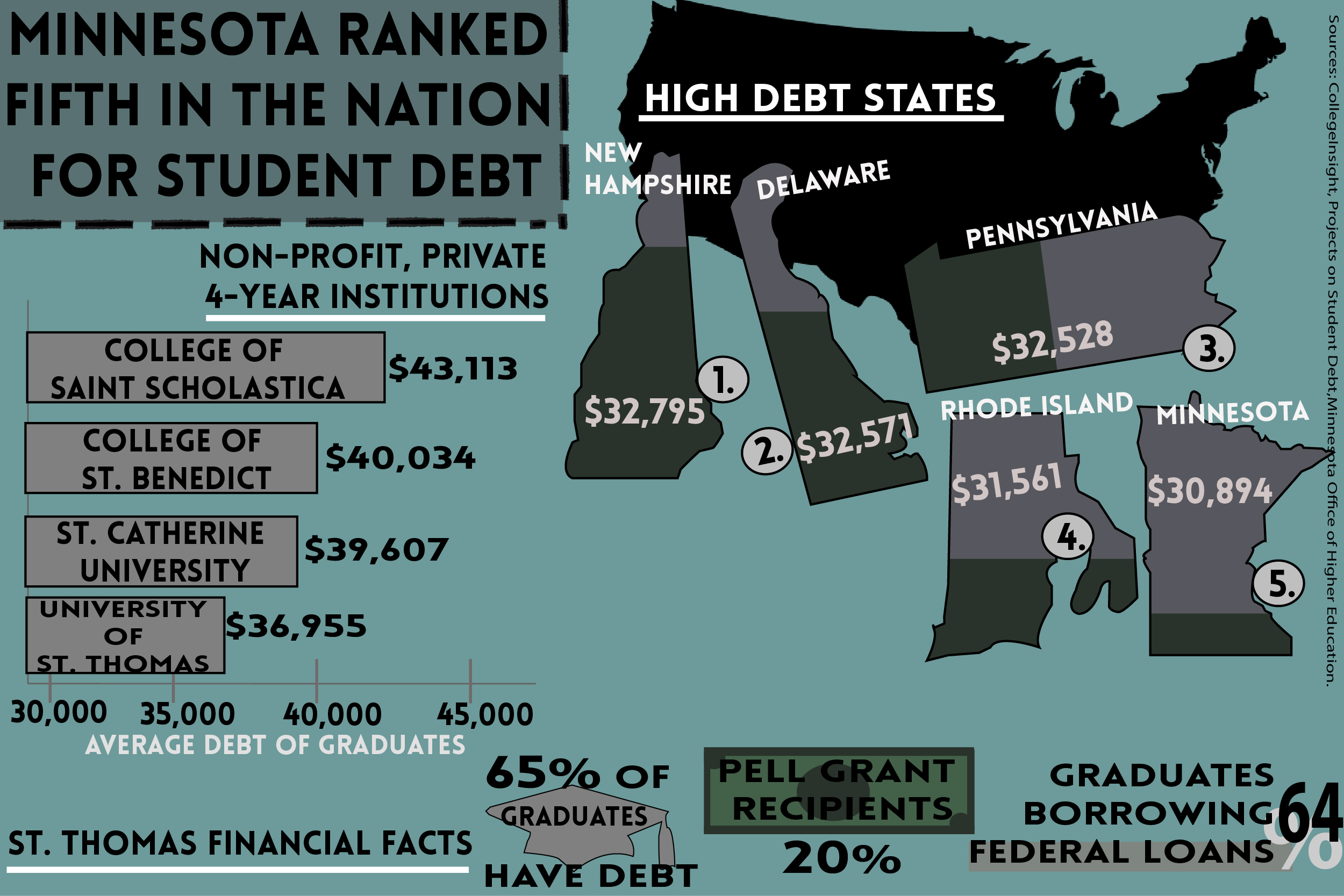

Minnesota is ranked fifth in the nation for highest student debt, according to a November report by the Project on Student Debt. The report also ranked St. Thomas as fourth in the state among private, nonprofit universities in Minnesota for highest debt after graduation.

With 65 percent of graduating St. Thomas seniors saddled with student debt in 2013, Kris Roach, director of admissions and financial aid, noted that even though the average St. Thomas student debt is $36,955, the mean student debt is only $27,632 according to the Minnesota Office of Higher Education.

Despite the high ratings of Minnesota and St. Thomas, Roach said students should not be deterred from getting an education because of numbers.

“I don’t think any generation has wanted to put a heavy debt burden on their children,” Roach said. “Unfortunately, it’s happened, but it’s not quite as frightening as people think.”

Roach explained the extreme and uncommon cases of borrowing skew the average numbers, and most students are closer to the mean range after graduation. Additionally, the Project on Student Debt has reported an increase in the number of students enrolling in higher education, thereby increasing the amount of student debt.

Junior Robert Mason said he doesn’t think an increase in student debt is “necessarily a bad thing.”

“I think student debt almost means more kids are going to college, and there is an opportunity cost there,” Mason said. “People have the opportunity to choose not to go to college if they believe that’s the better life path, but the people who are choosing to go to college are willing to take on that debt because they believe they’ll get better jobs in the future.”

Even though some students end up struggling to pay off debt after graduation, Roach said it is concerning but not deterring students from seeking a college education.

“There’s a lot of conversation about (student debt),” Roach said. “I think that the concerns about the economy, the concerns about getting a job, the concerns about borrowing have all made students and their parents wiser consumers. They’re asking a lot of tougher questions early on.”

When it comes to paying for a private university education, Roach said there are three options: saving money and writing a check out of a savings account, paying straight out of pocket or borrowing from future earnings. Borrowing is the most common method, according to the Minnesota Office of Higher Education.

The cost of a private education leads some students to question if it’s more valuable than a state-subsidized education at a public university.

Freshman Madeline Schuster is able to attend St. Thomas through academic scholarships provided by the university.

“Yikes. That’s a lot of debt,” Schuster said of the average class debt. “I think that’s unfortunate, because we’re paying a lot of money to go here. And I think a lot of people would question whether it’s worth it (because of) how much we’re paying.”

But Roach said the debt from a private education isn’t insurmountable.

“There’s a myth that all private colleges are really expensive, and people can’t afford it,” Roach said. “That’s not true. It was a sacrifice to go to a private college when I went through, and it’s still a sacrifice. But it’s that idea that it’s an investment in your future. Our students do very well in terms of securing jobs and being able to repay their student loans.”

Roach added that the student loan default rate at St. Thomas is 4.2 percent compared to the national rate of 13.7 percent. The median household income is $53,046, and most employees will make around a million dollars over their lifetime, according to the U.S. Census Bureau.

Roach thinks the debt is worth it if students are set up to pay it off after graduation.

“If you borrow $30,000 to make a million dollars more, is that worth it? I’m not a debt advocate,” Roach said. “What I’m an advocate for is responsible borrowing. It maybe means … you can only go on one study abroad program or that you have to work during school so that you borrow a little less.”

Mason agreed that if you take advantage of your time in college, you’ll be able to eventually pay off your student debt.

“I think it’s worth it. The opportunities you have coming out of college are much greater with a degree. I already know what I want to do, but I need the piece of paper,” Mason said. “In college you have a great opportunity to get yourself ready for the future.”

Schuster thinks students should look at a degree as a means of getting a job instead of as an expensive piece of paper.

“I’m extremely fortunate that I didn’t have to take out any loans this year, but I definitely will have to next year,” Schuster said. “I think just being smart about my education and choosing to go into a good field is going to help me to pay off my debts afterwards. It’s a broken system, but it’s the only one we got.”

The value of a college degree is much greater than a piece of paper, according to Roach. It also includes the experiences and memories of a four-year education, something that can’t be captured by numbers.

“(College) was a sacrifice. But I can look anybody in the eye and say I would do it again,” Roach said. “It’s the intangible part of an education. These stats don’t touch what happens when you’re in college, and you’re in these wonderful classes with great faculty. There’s something that is transformative in that experience.”

Simeon Lancasters can be reached at lanc4637@stthomas.edu.

Guess I’m not an average UST student, with my UST debt load over $100,000

When you charge $45,000+ in tuition, and rising, a figure decided on to simply match what other schools are charging and so to appear “elite”(knowledge I gained while attending a UST board meeting while Senior Class President), you’re essentially asking more and more of your students to go deeper and deeper into debt. I got all the scholarships I could get, and worked a part-time job all four years, but that still wasn’t enough to keep my debt load near reasonable. Don’t have rich parents either. I absolutely loved the education I got at UST, but it sucks I’ll be paying off these loans for the next 20 years.